From October, your health insurance policies will receive a much-needed revamp and they will be re-introduced in accordance with the guidelines and specifications issued. This new guideline are issued by Insurance Regulatory and Development Authority of India (IRDAI). New modified revamped policies will come into effect from October 1, 2020 and the new changes will be applicable on all existing and new health insurance policies. As per new policy rule it is set for customers the revised policies will mean cover for more illnesses and procedures at affordable prices.

Cover for New Ailments

IRDAI the insurance regulatory body has issued a list of guidelines that specify the various illnesses that will now be covered under a regular health insurance cover. As per new modified rules in future insurers will be barred from excluding illnesses contracted due to hazardous activity. And also it includes the treatment for mental illness, age-related degeneration, internal congenital diseases and artificial life maintenance will be covered under a comprehensive health insurance plan.

No Rejection of Claim After 8 Years

In the year of 2019 June last year IRDAI stated that if a health insurance policy has completed eight years, for example if any policyholder has been paying premium for 8 years without pause a health insurance claim cannot be rejected except for proven fraud and permanent exclusions. This rules means a customer’s health insurance claim won’t be rejected from the ninth policy year unless you have indulged in fraud or are making a claim for a permanent exclusion.

New Definition of PED

New rules also established the definition of pre-existing diseases (PED) has to be modified to cater to the needs and requirements of customers. As per IRDAI new issued guidelines any disease/s or ailment/s that is/are diagnosed by a physician 48 months before issuance of the health cover will be classified under PED.

Paying health insurance premiums in EMIs

Due to pandemic amidst the ongoing COVID-19 outbreak, IRDAI came out with a circular in June for minor modifications which set aside for policy holder where in policies filed by general and standalone health insurers. According to the new circular the regulator allowed the payment of health insurance premiums in instalments. With new options entirely up to the insurers to decide whether or not to offer the facility of paying premiums in instalments to the customers.

![Visa and Social Media [TKB World]](https://topknowledgebox.com/iphaphoo/2025/12/15122025.jpg)

![Vishwakarma Puja 2025 [TKB- INDIA]](https://topknowledgebox.com/iphaphoo/2025/09/17092025-150x150.jpg)

![Ganesh Chaturthi 2025[TKB-INDIA]](https://topknowledgebox.com/iphaphoo/2025/08/27082025-150x150.jpg)

![Buddha Purnima 2025 [TKB INDIA]](https://topknowledgebox.com/iphaphoo/2025/05/12052025-150x150.jpg)

More Stories

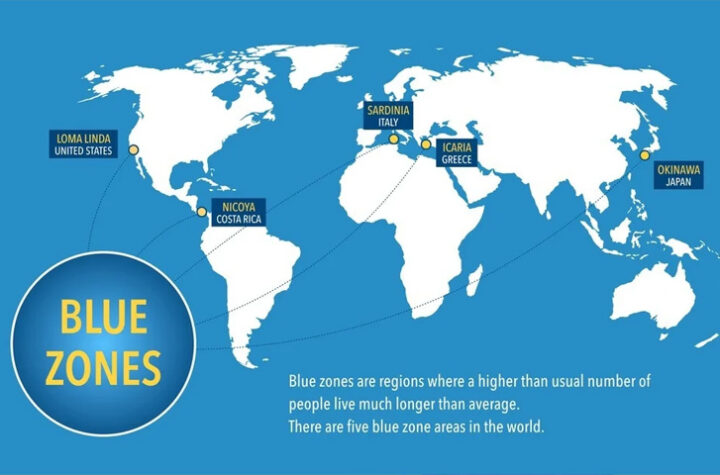

Why do people living in blue zones live longer? 3 reasons that will change your thinking

Essential Oil For Skin[TKB Health]

Chia seeds will give double benefits [TKB Health]